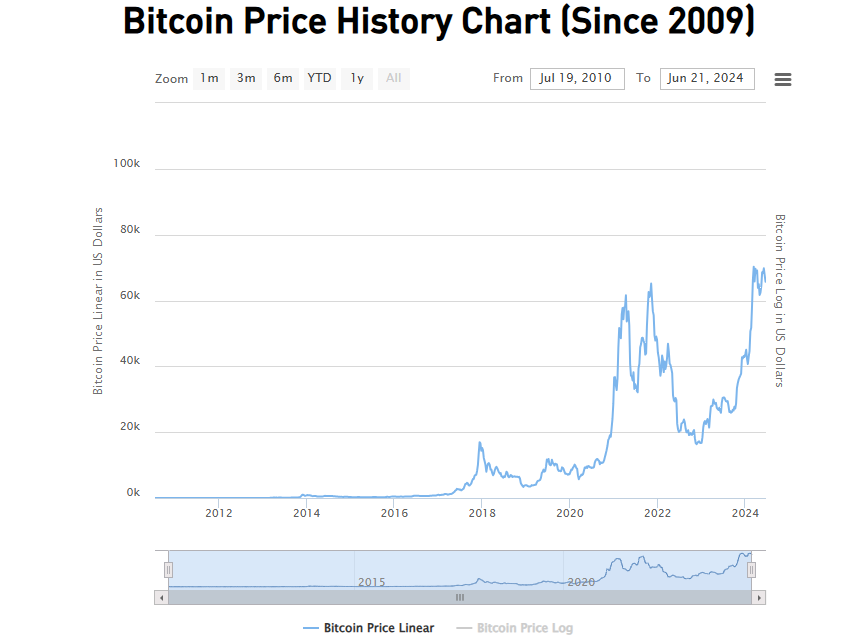

In the past few years, there have been big changes in the price of Bitcoin. There are many factors that contribute to this volatility, including market demand, investor sentiment, changes in regulations, and the impact of the media.

The price of bitcoin

The price of Bitcoin, the first cryptocurrency, has changed a lot over the past few years because of the actions and presence of institutional buyers. A lot of information is given in this piece about how big buyers and changes in the price of Bitcoin are connected. It looks at what makes them act the way they do and the plans they make to deal with the unstable coin market. We want to show you how institutional buyers affect the current price trends of Bitcoin by looking at how prices have changed in the past, how rules are evolving, and how people feel about the market.

An overview of the Bitcoin business for big investors

It’s our job to find out what role institutional buyers play in the cryptocurrency market.

It is big buyers who have been making waves in the volatile cryptocurrency market, especially when it comes to Bitcoin. This is because they have a lot of money and power.A look at the past: how the interest of big businesses in Bitcoin has changed over time

Institutions’ Bitcoin involvement has grown from doubt to interest over time. Institutions, which used to be looked down upon, now have a lot of power over market trends.

Some of the things that make institutional buyers change the price of Bitcoin

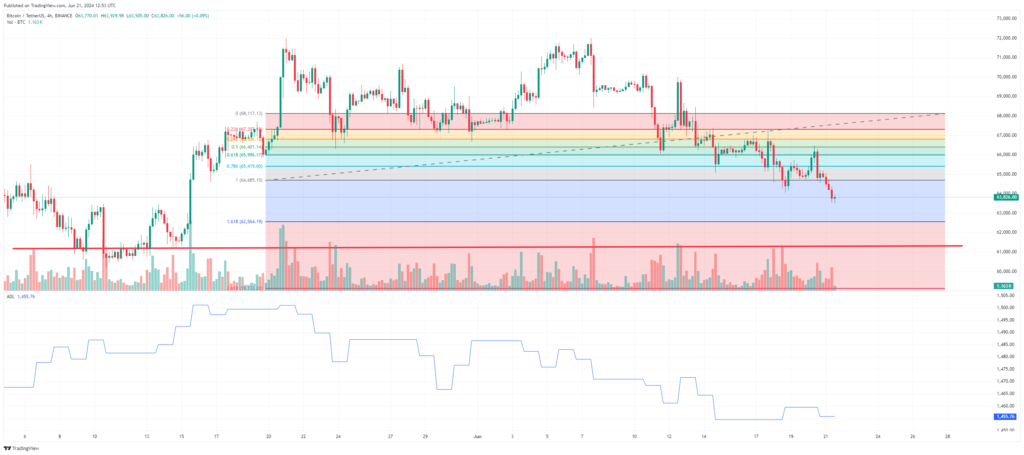

How much money investors have in the market and how big and open the market is all affect the price of Bitcoin.

When big companies start using Bitcoin, it makes news all over the world. Bitcoin prices can change a lot based on how much they trade for and how big they are.

Large-scale economic factors: how events around the world affect what institutional buyers do

Investors don’t work alone; that’s not true. If there are trade wars or policy changes that affect economies all over the world, it can cause people to make decisions that change the prices of Bitcoin.

How the tactics of big investors change the price of bitcoin

To figure out how big players move their money and how that impacts price changes,

They’re not just there to buy and hold. The way they trade can make the market go crazy, with prices going through the roof or dropping sharply at any time.

How the mood of big investors causes changes in prices

It’s not true that organizations don’t feel anything. The way they feel can change the market, which can lead to price changes that make buyers wonder what’s going on.

Changes in rules and how they affect the way big companies act

How clear rules affect how much money big companies choose to put into Bitcoin

Rules can be good or bad for big companies. When people don’t know what to do, they may walk or run away carefully. Clear rules can give people confidence.

Guides for big investors in the cryptocurrency market on how to follow the rules and send in their paperwork

The bitcoin market doesn’t let big businesses do what they want. They follow the rules and report anything that goes wrong. This makes sure that everyone has an equal chance to win.

Taking a look at how big buyers feel about the market and how that impacts the price of bitcoin

Tools that big buyers in Bitcoin use to look at public opinion

To find out how institutional investors change the direction of Bitcoin prices, sentiment study is a very useful tool. These big players use complicated tools, such as keeping an eye on social media, looking at what people say about the market in the news, and their own unique formulas, to find out how people feel about it. Case Studies: Examples of Times When institutional feelings cause significant price changes, the price of Bitcoin can change based on how big buyers feel about it. Like, when a well-known group says nice things about Bitcoin, the price might go up a lot. When big players are negative, on the other hand, prices can drop quickly.

Things that individual investors can do to deal with the impact of institutional bias in Bitcoin trading

How small buyers can keep an eye on what big companies are doing in the stock market and how they can respond

If small investors follow market news, watch how big investors act, and spread out their investments, they won’t be affected by what big investors do. It’s important to plan your response to large-scale buying and not let short-term price changes affect your choices.

Diversification and risk management plans for when institutions are involved

Big buyers have a lot of power in the Bitcoin market, so small players need to spread their bets around. Putting their money into a range of assets can lower the risks that come with price changes that happen quickly because of what companies do. Managing risk is another way to help keep cash safe.

Case studies: researching how big buyers have changed the price of bitcoin in the past

Case study 1: More money from big businesses and how that changed the price of bitcoin

A look at a well-known case in which more investments from big businesses directly affected the price of Bitcoin. This shows how important big businesses are in changing how markets work.

Case Study 2: When the rules changed in the Bitcoin market and how banks responds

We will look at an example of how institutions in the Bitcoin market responded to changes in the rules. This will show how outside factors can make institutions act in ways that change price trends.

Looking to the future: figuring out how big buyers will change the price of bitcoin in the future?

What are the trends and predictions for the Bitcoin market? How will institutional power affect it?

Some experts believe that big buyers will continue to have an impact on Bitcoin’s price in the years to come. Investors of all levels can do better in the market if they know about these trends.

Why new technologies are important for Bitcoin and how they help bring in big capital.

Bitcoin is likely to get more money from big businesses in the future. which could change the way its price moves. In this case, this is because technology is always getting better, like with the blockchain, and more businesses are using digital assets. It’s clear that institutional buyers will continue to have a big impact on the market as long as they buy Bitcoin.

For individual investors

It’s good for individual investors to know about and adjust to the power of institutional players, using tactics to deal with volatile markets and seize new opportunities. Big investors are making changes to the way Bitcoin is traded. Investors can get ready for these changes by learning more about them and doing something about it.

FAQs

1. What does it mean when big buyers buy a lot of Bitcoin?

It’s a very good sign when billionaires buy Bitcoin. Because there are only so many Bitcoins to go around, their buying can cause prices to rise significantly for everyone else.

2. What makes big buyers in the Bitcoin market choose what to do?

When making choices, big buyers in the Bitcoin market look at things like supply and demand, the state of the economy as a whole, and the rules and regulations that apply. They also keep an eye on network protection and social media trends.

3. And finally, what can individual buyers do about the effect that big players have on Bitcoin trading?

People who want to buy Bitcoin can spread out their investments, so they don’t rely on it all the time and keep up with market trends to make smart choices.

4. Do changes in the rules have a big impact on how?

Of obviously! When government rules change, they have a big effect on Bitcoin prices. When a rule supports Bitcoin, more people want it, which drives up prices. On the other hand, rules that are too strict can cause sale-offs and price drops.